Home /

Expert Answers /

Accounting /

riverrocks-realizes-that-it-will-have-to-raise-the-financing-for-the-acquisition-of-raft-adventures-pa966

(Solved): RiverRocks realizes that it will have to raise the financing for the acquisition of Raft Adventures ...

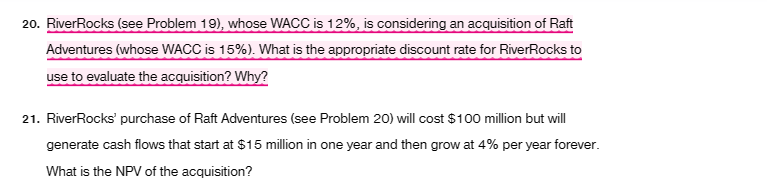

RiverRocks realizes that it will have to raise the financing for the acquisition of Raft Adventures (described in Problems 20 and 21) by issuing new debt and equity. River-Rocks estimates that the direct issuing costs will amount to $7 million. How should it account for these costs in evaluating the project? Should RiverRocks go ahead with the project? Answer this question just post the Question 20& 21 for reference

20. RiverRocks (see Problem 19), whose WACC is \( 12 \% \), is considering an acquisition of Raft Adventures (whose WACC is 15\%). What is the appropriate discount rate for RiverRocks to use to evaluate the acquisition? Why? 21. RiverRocks' purchase of Raft Adventures (see Problem 20) will cost \( \$ 100 \) million but will generate cash flows that start at \( \$ 15 \) million in one year and then grow at \( 4 \% \) per year forever. What is the NPV of the acquisition?

Expert Answer

We can use the net present value (NPV) method to assess RiverRocks' purchase of Raft Adventures. The NPV approach accounts for the cost of financing w