Home /

Expert Answers /

Accounting /

suppose-autodesk-stock-has-a-beta-of-2-15-whereas-costco-stock-has-a-beta-of-0-72-if-the-risk-f-pa776

(Solved): Suppose Autodesk stock has a beta of 2.15 , whereas Costco stock has a beta of 0.72 . If the risk-f ...

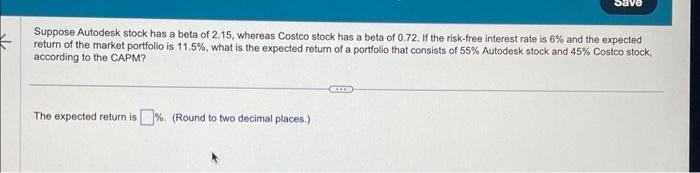

Suppose Autodesk stock has a beta of 2.15 , whereas Costco stock has a beta of 0.72 . If the risk-free interest rate is and the expected return of the market portfolio is , what is the expected return of a portfolio that consists of Autodesk stock and Costco stock. according to the CAPM? The expected return is \%. (Round to two decimal places.)

Expert Answer

Calculation of the expected return (ER) on Autodesk stockER on Autodesk stock = RFR + Beta X (ERM - RFR)= 6% + 2.15 x (11.5% - 6%)= 6% + 2.15 x 5.5%= 6% + 11.825%= 17.825%Expected return on Auto Desk = 17.825%