(Solved): Suppose you observe that 90 -day interest rate across the eurozone is 7%, while the interest rate in ...

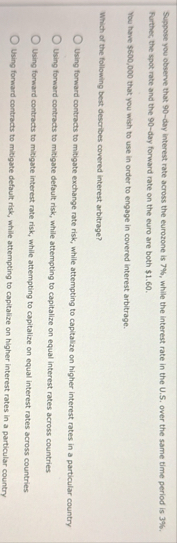

Suppose you observe that 90 -day interest rate across the eurozone is

7%, while the interest rate in the U.S. over the same time period is

3%. Further, the spot rate and the an-day forward rate on the euro are both

$1.60. You have

$600,000that you wish to use in order to engage in covered interest arbitrage. Which of the following best describes covered interest arbitrage?

?Using forward contracts to mitigate exchange rate risk, while attempting to capitalize on higher interest rates in a particular country

?Using forward contracts to mitigate default risk, while attempting to capitalize on equal interest rates across countries

?Using forward contracts to mitigate interest rate risk, while attempting to capitalize on equal interest rates across countries

?Using forward contracts to mitigate default risk, while attempting to capitalize on higher interest rates in a particular country