(Solved): \table[[Pre-adjustment trial balance as at 29 February 2024,Debit,Credit],[Land and buildings at cos ...

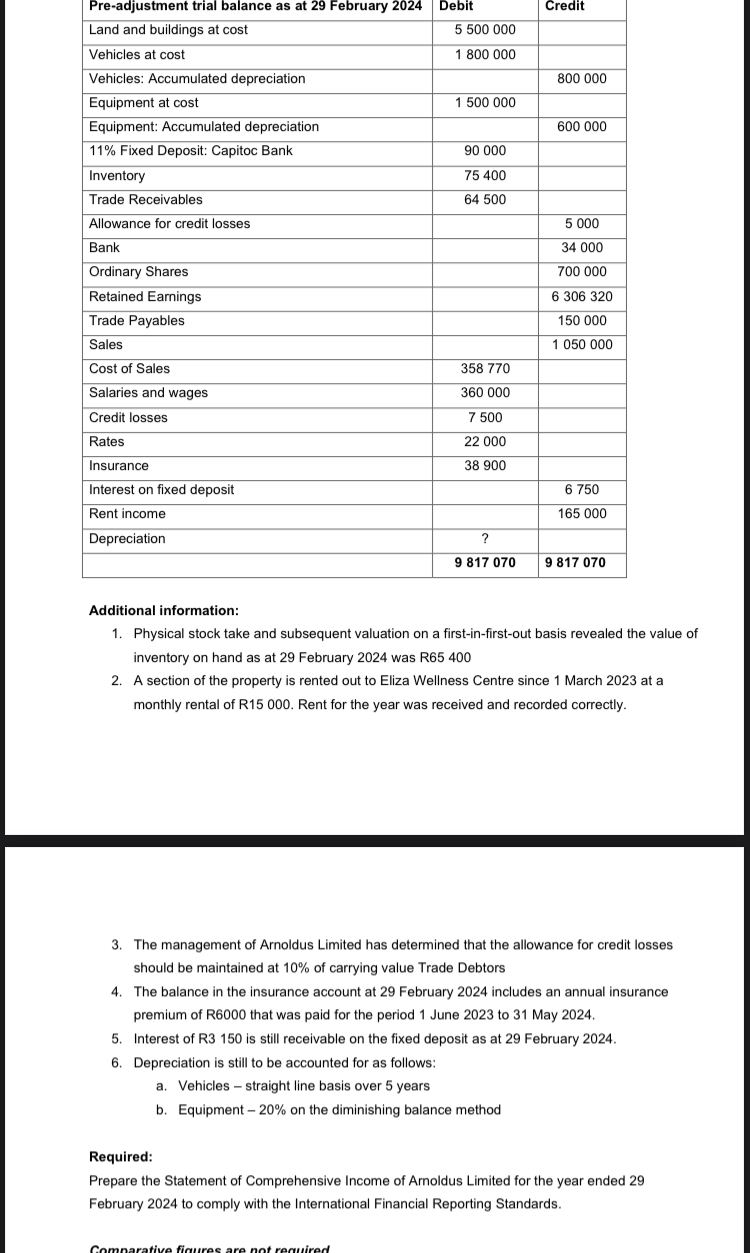

\table[[Pre-adjustment trial balance as at 29 February 2024,Debit,Credit],[Land and buildings at cost,5500000,],[Vehicles at cost,1800000,],[Vehicles: Accumulated depreciation,,800000],[Equipment at cost,1500000,],[Equipment: Accumulated depreciation,,600000],[11% Fixed Deposit: Capitoc Bank,90000,],[Inventory,75400,],[Trade Receivables,64500,],[Allowance for credit losses,,5000],[Bank,,34000],[Ordinary Shares,,700000],[Retained Earnings,,6306320],[Trade Payables,,150000],[Sales,,1050000],[Cost of Sales,358770,],[Salaries and wages,360000,],[Credit losses,7500,],[Rates,22000,],[Insurance,38900,],[Interest on fixed deposit,,6750],[Rent income,,165000],[Depreciation,?,],[9817070,9817070]] Additional information: Physical stock take and subsequent valuation on a first-in-first-out basis revealed the value of inventory on hand as at 29 February 2024 was R65 400 A section of the property is rented out to Eliza Wellness Centre since 1 March 2023 at a monthly rental of R15 000. Rent for the year was received and recorded correctly. The management of Arnoldus Limited has determined that the allowance for credit losses should be maintained at

10%of carrying value Trade Debtors The balance in the insurance account at 29 February 2024 includes an annual insurance premium of R6000 that was paid for the period 1 June 2023 to 31 May 2024. Interest of R3 150 is still receivable on the fixed deposit as at 29 February 2024. Depreciation is still to be accounted for as follows: a. Vehicles - straight line basis over 5 years b. Equipment

-20%on the diminishing balance method Required: Prepare the Statement of Comprehensive Income of Arnoldus Limited for the year ended 29 February 2024 to comply with the International Financial Reporting Standards.