(Solved): Tax Drill - Tax Planning for Nonrecopnition Provisions Indicate whether the following statements are ...

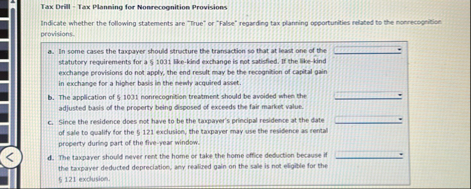

Tax Drill - Tax Planning for Nonrecopnition Provisions Indicate whether the following statements are "True" or "False" regarding tax planting opporturities related to the nonrecoprition provisions. a. In some cases the taxpayer should structure the transaction sos that at leant one of the statutory requirements for a 51091 Iike-kind exchange is not satisfied. IF the libe-kind exchange provisions do not apply, the end ressilt may be the recpgnition of capital gain in exchange for a higher basis in the newly acquired asset. b. The application of 5.1091 nonrecognition treatment should be avoided when the adjusted basis of the property being disposed of exceeds the fair market value. C. Since the residence does not have to be the taparer's principal residence at the date of sale to qualify for the

$.121exclusion, the taopayer may use the residence as rental property during part of the fire-pear window. d. The taxpayer should netver rent the home or take the home office deduction because if

?the tampayer deducted depreclation, any realized gain on the sale is not eligille for the 5121 exdusion.