Home /

Expert Answers /

Accounting /

tb-mc-qu-04-107-static-for-purposes-of-determining-filing-status-for-purposes-of-determining-f-pa599

(Solved): TB MC Qu. 04-107 (Static) For purposes of determining filing status... For purposes of determining f ...

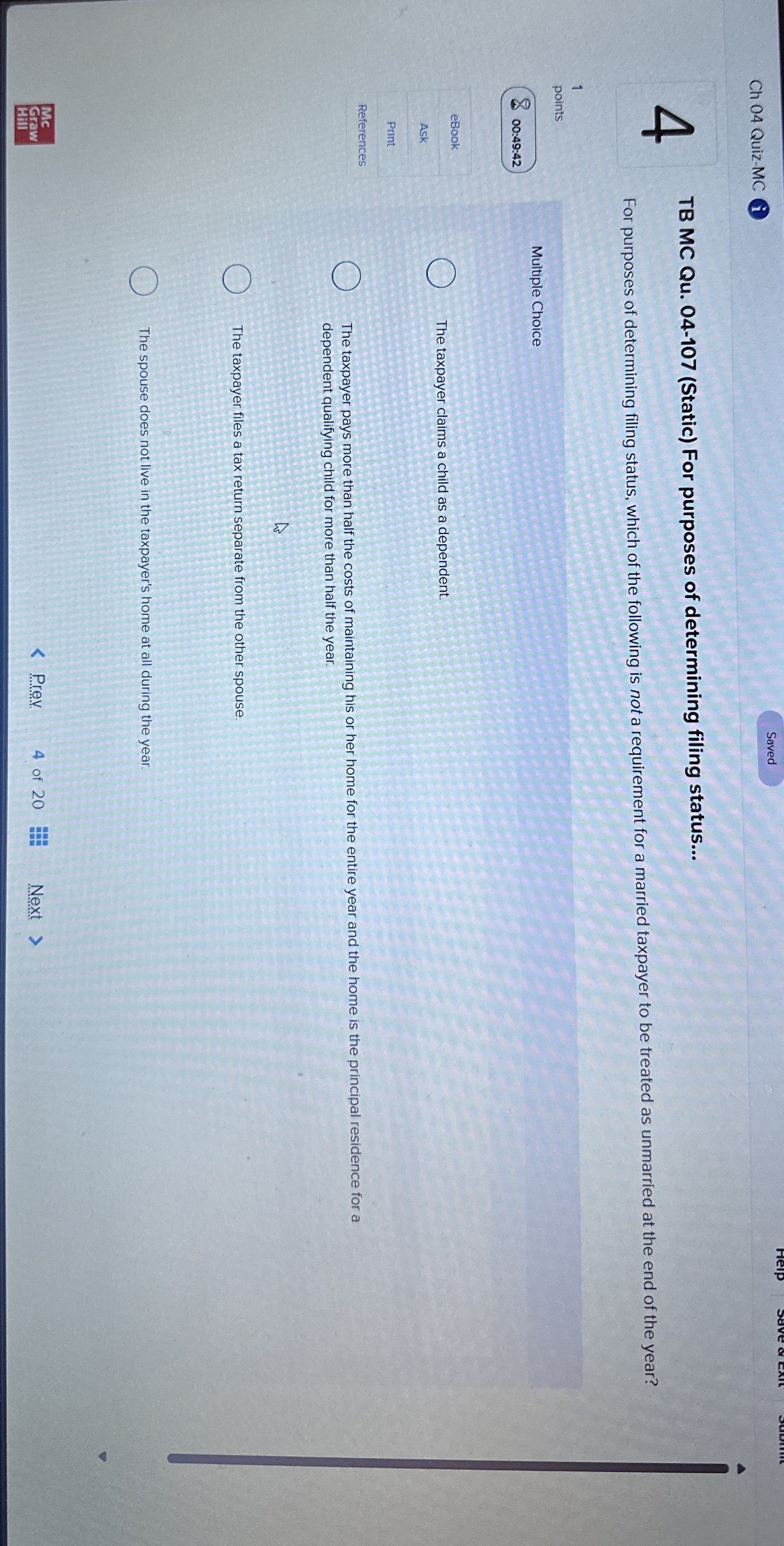

TB MC Qu. 04-107 (Static) For purposes of determining filing status... For purposes of determining filing status, which of the following is not a requirement for a married taxpayer to be treated as unmarried at the end of the year? References The taxpayer pays more than half the costs of maintaining his or her home for the entire year and the home is the principal residence for a dependent qualifying child for more than half the year. The taxpayer files a tax return separate from the other spouse. The spouse does not live in the taxpayer's home at all during the year.