Home /

Expert Answers /

Accounting /

the-act-contains-a-general-anti-avoidance-provision-often-referred-to-as-the-gaar-which-one-of-the-pa945

(Solved): The Act contains a general anti-avoidance provision often referred to as the GAAR. Which one of the ...

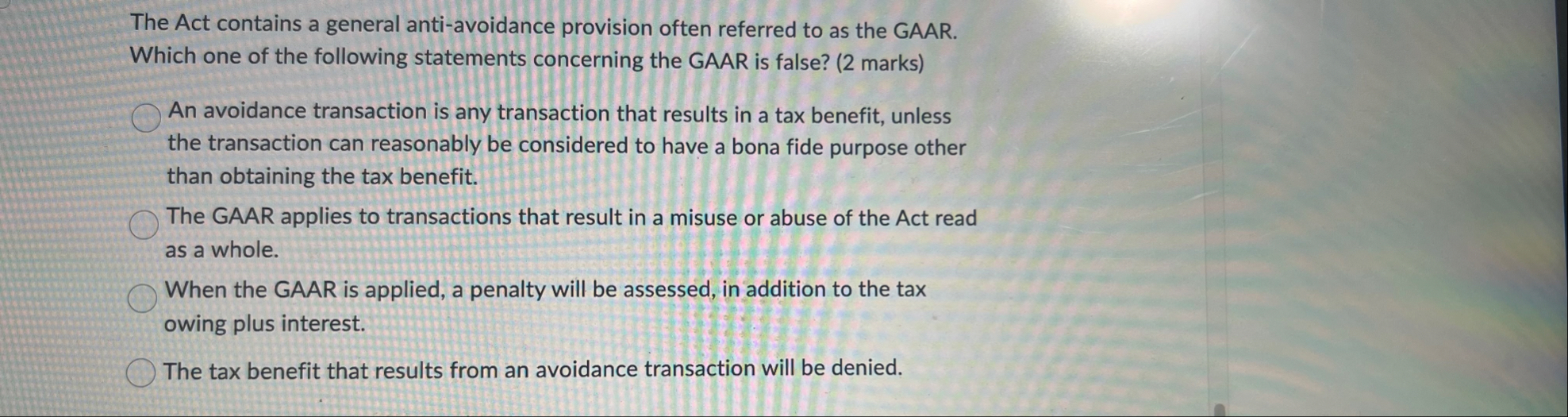

The Act contains a general anti-avoidance provision often referred to as the GAAR. Which one of the following statements concerning the GAAR is false? (2 marks) An avoidance transaction is any transaction that results in a tax benefit, unless the transaction can reasonably be considered to have a bona fide purpose other than obtaining the tax benefit. The GAAR applies to transactions that result in a misuse or abuse of the Act read as a whole. When the GAAR is applied, a penalty will be assessed, in addition to the tax owing plus interest. The tax benefit that results from an avoidance transaction will be denied.