Home /

Expert Answers /

Accounting /

the-irs-would-most-likely-apply-the-arm-39-s-length-transaction-test-to-determine-which-of-the-follo-pa485

(Solved): The IRS would most likely apply the arm's length transaction test to determine which of the followin ...

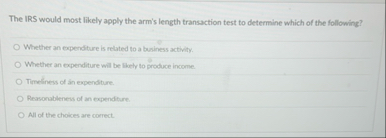

The IRS would most likely apply the arm's length transaction test to determine which of the following? Whether an expenditure is related to a business activity. Whether an expenditure will be likely to oncoluce income. Tireliness of an expenditure. Reasonableness of an expenditure. All of the chaires are covert.