Home /

Expert Answers /

Finance /

tierra-had-164-000-of-income-from-wages-and-3-000-of-taxable-interest-tierra-als-pa808

(Solved): Tierra had \( \$ 164,000 \) of income from wages and \( \$ 3,000 \) of taxable interest. Tierra als ...

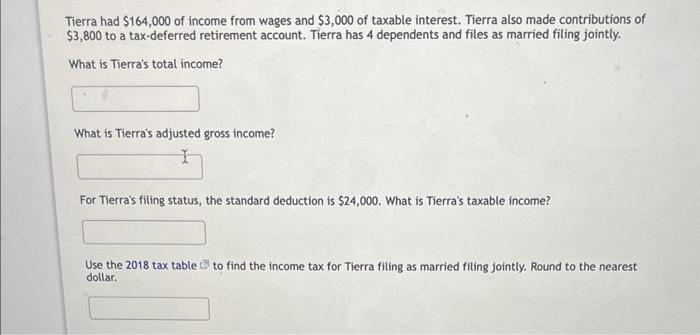

Tierra had \( \$ 164,000 \) of income from wages and \( \$ 3,000 \) of taxable interest. Tierra also made contributions of \( \$ 3,800 \) to a tax-deferred retirement account. Tierra has 4 dependents and files as married filing jointly. What is Tierra's total income? What is Tierra's adjusted gross income? For Tierra's filing status, the standard deduction is \( \$ 24,000 \). What is Tierra's taxable income? Use the 2018 tax table \( { }^{2} \) to find the income tax for Tierra filing as married filing jointly. Round to the nearest dollar.

Expert Answer

(1) Tierra's total income = Income from wages + Interest income = 164,000 +