Home /

Expert Answers /

Finance /

tinsley-incorporated-wishes-to-maintain-a-growth-rate-of-12-percent-per-year-and-a-debt-equity-rat-pa142

(Solved): Tinsley, Incorporated, wishes to maintain a growth rate of 12 percent per year and a debt-equity rat ...

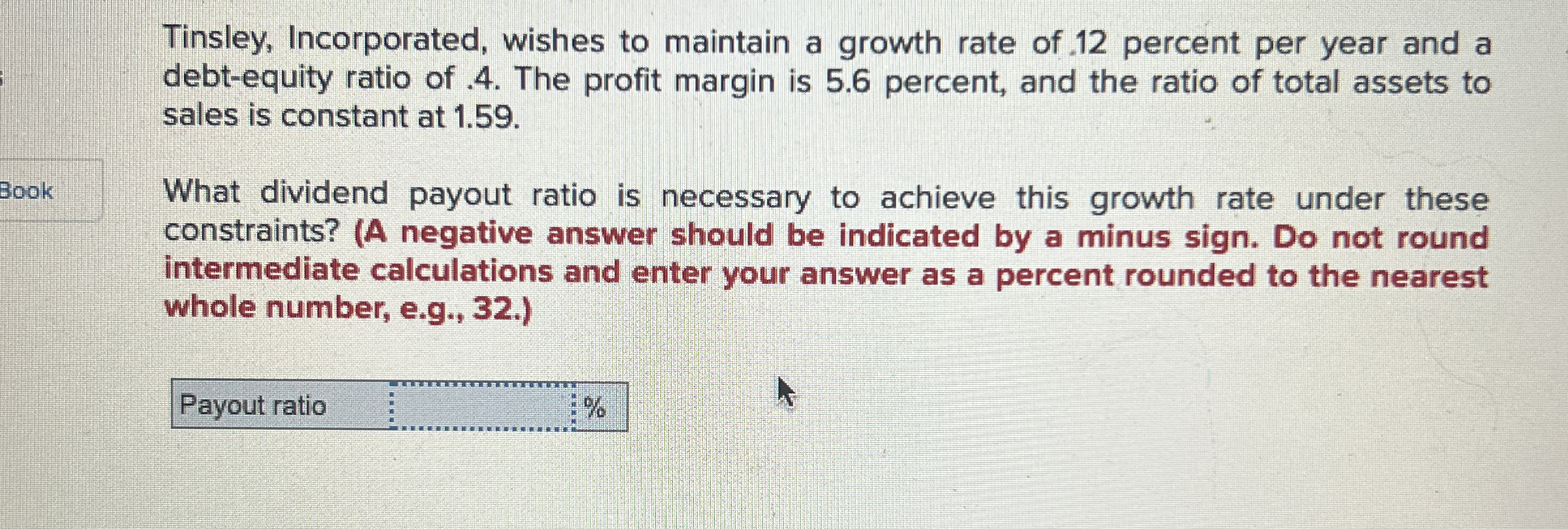

Tinsley, Incorporated, wishes to maintain a growth rate of 12 percent per year and a debt-equity ratio of .4 . The profit margin is 5.6 percent, and the ratio of total assets to sales is constant at 1.59 . What dividend payout ratio is necessary to achieve this growth rate under these constraints? (

Anegative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to the nearest whole number, e.g., 32.) Payout ratio

?