Home /

Expert Answers /

Accounting /

under-the-augusta-rule-what-happens-if-you-rent-your-personal-residence-for-20-days-during-the-year-pa348

(Solved): Under the Augusta rule, what happens if you rent your personal residence for 20 days during the year ...

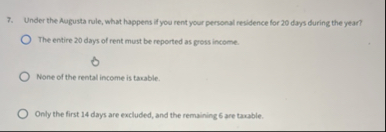

Under the Augusta rule, what happens if you rent your personal residence for 20 days during the year?

?The entire 20 days of rent must be reported as peoss innome

?None of the rental income is taxable.

?Only the first 14 days are excluded, and the remaining 6 are taxable.