(Solved): vork mode : This shows what is correct or incorrect for the work you have complet so far. It does no ...

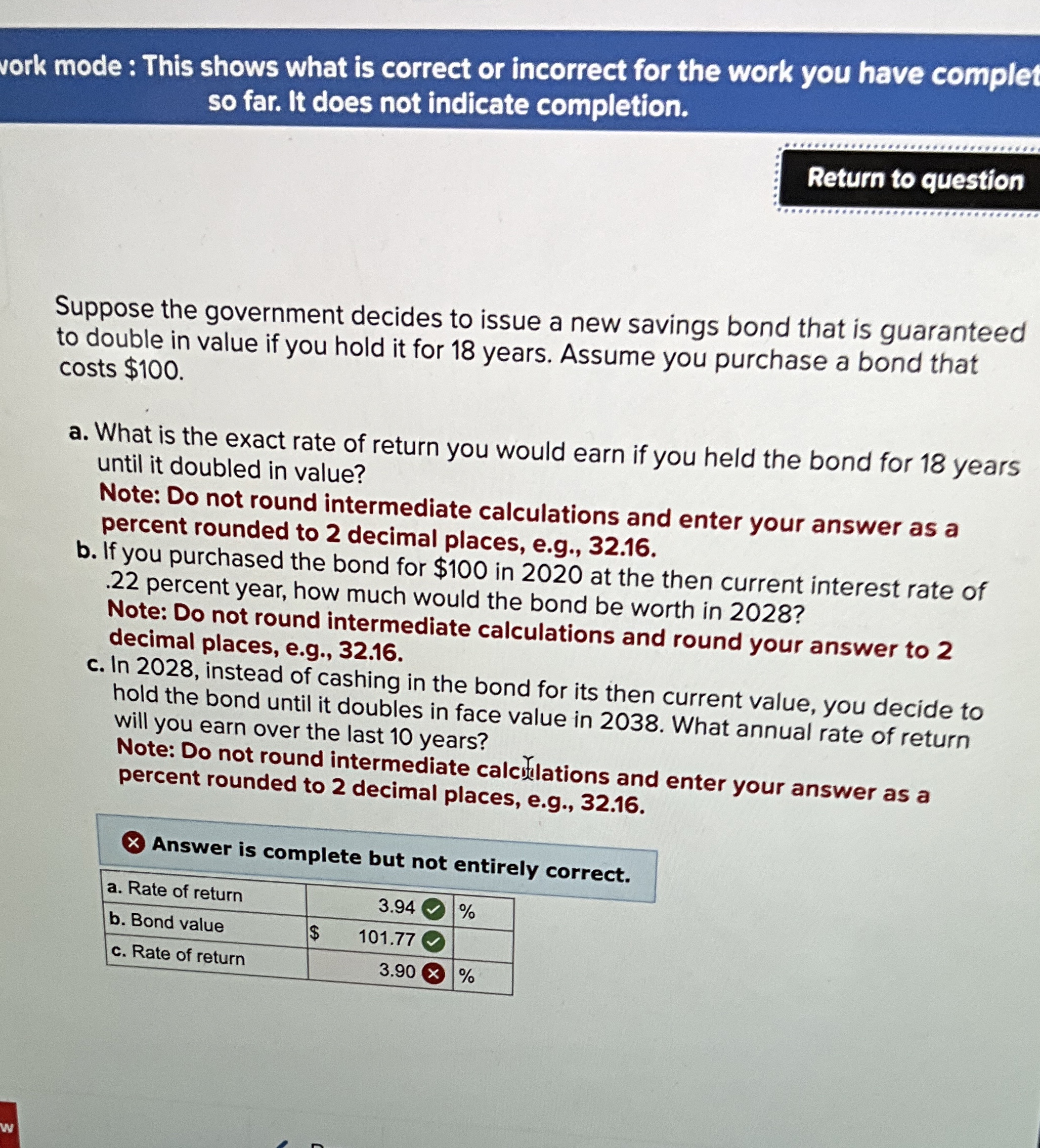

vork mode : This shows what is correct or incorrect for the work you have complet so far. It does not indicate completion. Return to question Suppose the government decides to issue a new savings bond that is guaranteed to double in value if you hold it for 18 years. Assume you purchase a bond that costs

$100. a. What is the exact rate of return you would earn if you held the bond for 18 years until it doubled in value? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. If you purchased the bond for

$100in 2020 at the then current interest rate of .22 percent year, how much would the bond be worth in 2028? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. In 2028 , instead of cashing in the bond for its then current value, you decide to hold the bond until it doubles in face value in 2038. What annual rate of return will you earn over the last 10 years? Note: Do not round intermediate calceflations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Answer is complete but not entirely correct. \table[[a. Rate of return,

3.94vv,

%