(Solved): WACC Estimation The following table gives the balance sheet for Travellers Inn Inc. (TII), a compan ...

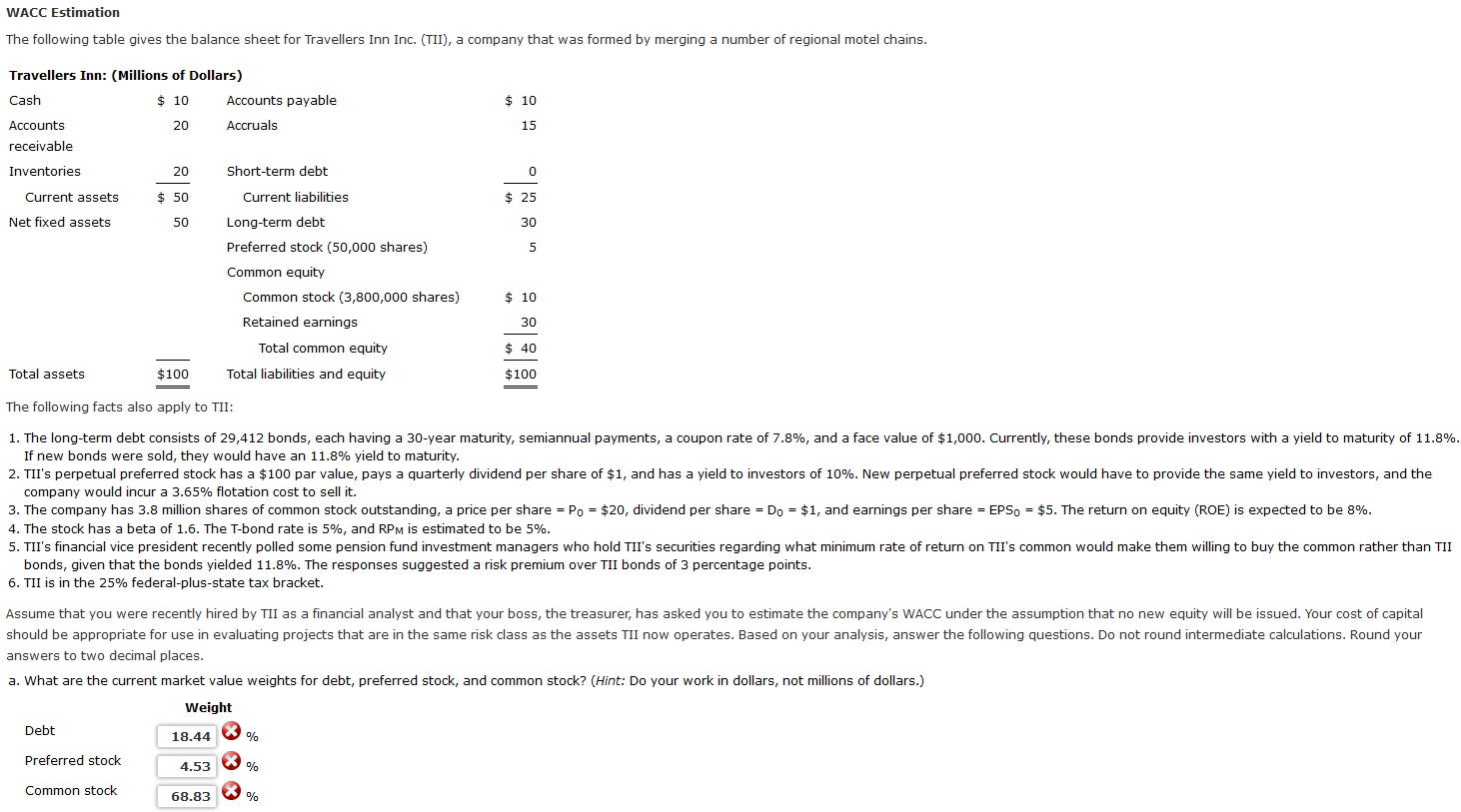

WACC Estimation The following table gives the balance sheet for Travellers Inn Inc. (TII), a company that was formed by merging a number of regional motel chains. Travellers Inn: (Millions of Dollars)Accounts receivable The following facts also apply to TII: If new bonds were sold, they would have an \( 11.8 \% \) yield to maturity. company would incur a \( 3.65 \% \) flotation cost to sell it. 4. The stock has a beta of 1.6 . The T-bond rate is \( 5 \% \), and RP M is estimated to be \( 5 \% \). bonds, given that the bonds yielded \( 11.8 \% \). The responses suggested a risk premium over TII bonds of 3 percentage points. 6. TII is in the 25\% federal-plus-state tax bracket. answers to two decimal places. a. What are the current market value weights for debt, preferred stock, and common stock? (Hint: Do your work in dollars, not millions of dollars.) b. What is the after-tax cost of debt? \% c. What is the cost of preferred stock? \% d. What is the required return on common stock using CAPM? \% \% f. What is the required return on common stock using the own-bond-yield-plus-judgmental-risk-premium approach? \% g. What is Travellers' WACC? Use the required returns on stock from part e. \%