Home /

Expert Answers /

Finance /

which-one-of-the-following-statements-is-accurate-a-a-portfolio-of-u-s-treasury-bills-will-have-a-pa740

(Solved): Which one of the following statements is accurate? a. A portfolio of U.S. Treasury bills will have a ...

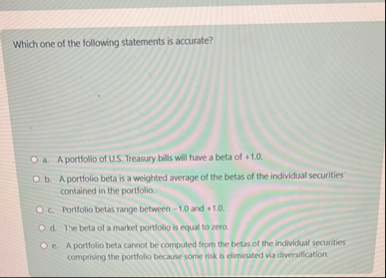

Which one of the following statements is accurate? a. A portfolio of U.S. Treasury bills will have a beta of

1,0. b. A portfolio beta is a weighted average of the betas of the individual securities contained in the portfolio. c. Portfolio betas range between -1.0 and 1.0 . d. The beta of a market portiolio is equal to zero. e. A portiolio beta cannot be computed from the betas of the individual securities comprising the portfolio because some risk is eliminated via diversification.