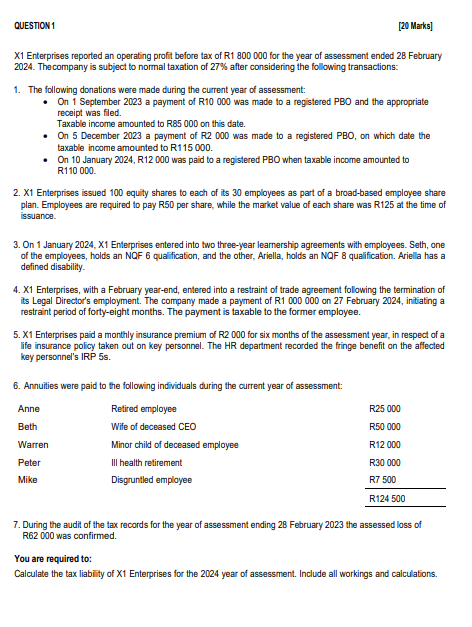

(Solved): X1 Enterprises reported an operating profit before tax of R1 800000 for the year of assessment ended ...

X1 Enterprises reported an operating profit before tax of R1 800000 for the year of assessment ended 28 February 2024. The company is subject to normal taxation of \( 27 \% \) after considering the following transactions: 1. The following donations were made during the current year of assessment: - On 1 September 2023 a payment of R10 000 was made to a registered PBO and the appropriate recaipt was filed. Taxable income amounted to R85 000 on this date. - On 5 December 2023 a payment of R2 000 was made to a registered PBO, on which date the taxable income amounted to R115 000. - On 10 January 2024, R12 000 was paid to a registered PBO when taxable income amounted to R110 000. 2. X1 Enterprises issued 100 equity shares to each of its 30 employees as part of a broad-based employee share plan. Employees are required to pay R50 per share, while the market value of each share was R125 at the time of issuance. 3. On 1 January 2024, X1 Enterprises entered into two three-year learnership agreements with employees. Seth, one of the employees, holds an NQF 6 qualification, and the other, Ariella, holds an NQF 8 qualification. Ariella has a defined disability. 4. X1 Enterprises, with a February year-end, entered into a restraint of trade agreement following the termination of its Legal Director's employment. The company made a payment of R1 000000 on 27 February 2024, intiating a restraint period of forty-eight months. The payment is taxable to the former employee. 5. X1 Enterprises paid a monthly insurance premium of R2 000 for six months of the assessment year, in respect of a life insurance policy taken out on key personnel. The HR department recorded the fringe benefit on the affected key personnel's IRP 5 s. 6. Annuities were paid to the following individuals during the current year of assessment: 7. During the audit of the tax records for the year of assessment ending 28 February 2023 the assessed loss of R62 000 was confirmed. You are required to: Calculate the tax liabiity of X1 Enterprises for the 2024 year of assessment. Include all workings and calculations.