1)

A) Gail has won the main lottery prize. He will receive $100,000 at the end of this year, $ 110,000 at the end of next year,$ 120,000 the following year, and so on, for 30 years. Leon offersGail $ 2.5 million today in exchange for all the money he willreceive in the future. If Gail can get an effective rate of 8percent a year on her savings, is it a good business to acceptLeon's offer?

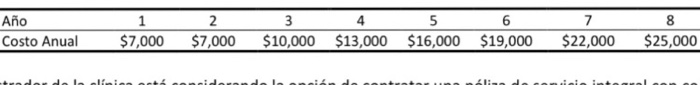

B) A 2nd care clinic. level is considering the purchase of aboiler within its operational infrastructure. The manufacturerreports the following series of annual maintenance costs for thefirst 8 years of operation.

The clinic administrator is considering the option ofcontracting a comprehensive service policy with coverage of 8years, if so, determine the maximum price that you would be willingto pay if the investment return of the institution is 12% per yeareffective.

C) A person wishes to purchase a piece of land within thefirst square of the city in order to convert it into a publicparking lot. Among the information collected so far, we have thefollowingi. The land needs an investment of $ 213,000 for adaptation,cleaning and construction of the necessary infrastructure to serveas a parking area.ii. A market study determined that the monthly demand forparking spaces in the area could generate an income of at least $8,000 per month and a maximum income of $ 12,000 per month.If the investor wishes to invest in this option in order torecover both the initial investment and the cost of the land in 4years. Determine the maximum purchase price of the land if theinvestor can obtain an alternative investment of 8% per year withmonthly capitalization

Año Costo Anual 1 $7,000 2 $7,000 3 4 5 6 $10,000 $13,000 $16,000 $19,000 7 $22,000 8 $25,000 la linianato dai